.svg)

.svg)

.svg)

Accurate and timely data is crucial for institutional investors to make informed decisions about their alternative asset allocations. The challenges traditionally associated with sharing and collecting this information can significantly impact how asset managers, their investors and channel partners navigate the fundraising process.Currently, these groups spend hundreds of hours each month manually entering data into non-standard Excel templates, PDF documents and investment databases. This resource-intensive process involves multiple parties and systems, which can inadvertently lead to redundancies and inefficiencies.

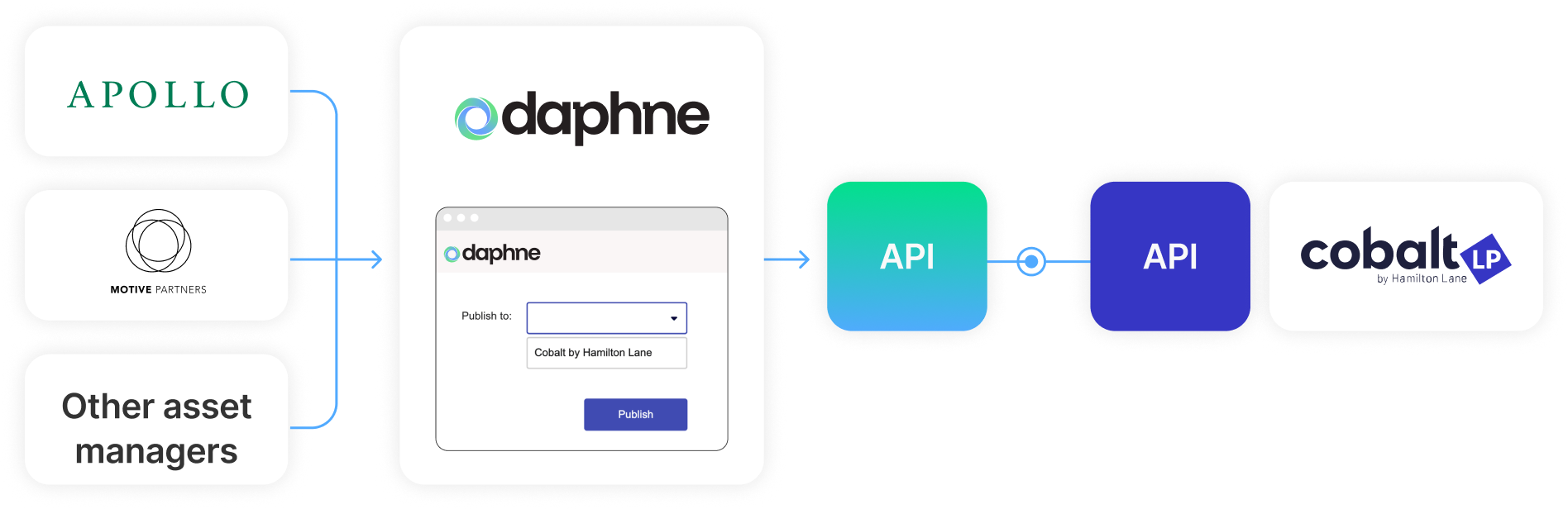

Hamilton Lane’s Cobalt technology is leveraged by institutional investors worldwide and exemplifies the firm’s commitment to developing a leading technology ecosystem for its teams and clients. Today, Cobalt features one of the largest comprehensive databases in the private markets industry.Cobalt has designated Daphne as its preferred method for receiving data related to new fund offerings. This pre-investment integration streamlines the fund data entry and publication processing while allowing General Partners (GPs) to maintain control over their data and client experience. Using Daphne’s structured data model, GPs can provide Hamilton Lane’s investment teams and clients with consistently structured, up-to-date and automated digital fund information, supporting diligence processes, portfolio construction tools and client communications systems.

Daphne allows GPs to implement a scalable distribution solution that maintains control over their brand, client experience and data while effortlessly expanding to additional distribution partners and LPs.

Deliver a superior fund marketing and distribution experience for channel partners and LPs

Accelerate time to market, eliminating months of manual effort per fund annually inputting product updates and reporting

Scale your business without adding extra operational burden: